RBI Clears Paytm Payments Arm for Offline transactions and cross-border payment aggregation, marking a decisive regulatory milestone for One 97 Communications Ltd. The Reserve Bank of India has authorised Paytm Payments Services Limited, a wholly owned subsidiary of Paytm, to operate as a Payment Aggregator for physical or offline payments and for cross-border transactions, covering both inward and outward flows. This approval comes in addition to the online Payment Aggregator licence that PPSL received in November 2025 under the Payment and Settlement Systems Act, 2007.

With this clearance, Paytm’s payments arm now holds Payment Aggregator licences across online, offline, and cross-border segments. As a result, the company can offer end-to-end payment aggregation services to merchants across domestic and international markets. This development is especially significant for Paytm, which has been rebuilding its payments infrastructure after regulatory restrictions were imposed on Paytm Payments Bank in 2024.

The approval allows Paytm to regain direct control over merchant onboarding, payment acceptance, and fund flows. Earlier, the company relied on third-party payment aggregators, which affected margins and operational flexibility. With PPSL now fully licensed, Paytm can deploy point-of-sale devices, soundboxes, and digital acceptance tools across India and overseas markets.

To support this expansion, Paytm infused Rs 2,250 crore into PPSL through a rights issue in December 2025. The company also transferred its offline merchant payments business to PPSL, consolidating operations under a regulated structure. Together, these moves strengthen Paytm’s long-term position in the fintech sector and place it among a limited group of regulated players authorised to handle online, offline, and cross-border payments on a single platform.

1. RBI Clears Paytm Payments Arm for Offline and Cross-Border Growth

The decision that RBI Clears Paytm Payments Arm for Offline transactions signals renewed regulatory confidence in Paytm’s payments business. The Reserve Bank of India has authorised Paytm Payments Services Limited to operate as a Payment Aggregator for physical merchant payments and cross-border transactions.

This approval enables PPSL to handle both inward and outward cross-border payment flows. It also complements the online payment aggregator licence granted earlier. Together, these approvals allow Paytm to offer a unified payment platform for merchants.

For Paytm, this clearance is not just regulatory compliance. It represents a strategic reset after a challenging phase. The company can now directly manage merchant payments without dependency on external aggregators.

1.1 Scope of the RBI Approval

The authorisation covers offline merchant payments through point-of-sale machines and soundboxes. It also includes cross-border transactions for international merchants and customers.

As RBI Clears Paytm Payments Arm for Offline use cases, PPSL can now support Indian merchants expanding overseas. At the same time, it can assist global merchants accepting payments from Indian customers.

This positions Paytm within a small group of regulated fintech firms operating across all payment modes.

1.2 Regulatory Background and Timeline

Paytm’s initial application for a payment aggregator licence was returned by the RBI in November 2022. The regulator raised concerns linked to past downstream investment issues.

Following government approvals, Paytm submitted a fresh application in September 2024. It received in-principle approval in August 2025. The final authorisation was granted in December 2025.

This long regulatory journey reflects the tightening of startup regulations in India’s fintech ecosystem.

2. Paytm and PPSL: Company Background and Evolution

One 97 Communications Ltd, founded in 2010, operates Paytm, one of India’s largest fintech platforms. The company started as a mobile recharge and bill payment service before expanding into digital wallets, merchant payments, and financial services.

Paytm Payments Services Limited was created as a subsidiary to handle merchant acquiring and payment aggregation. Over time, PPSL became central to Paytm’s payments strategy.

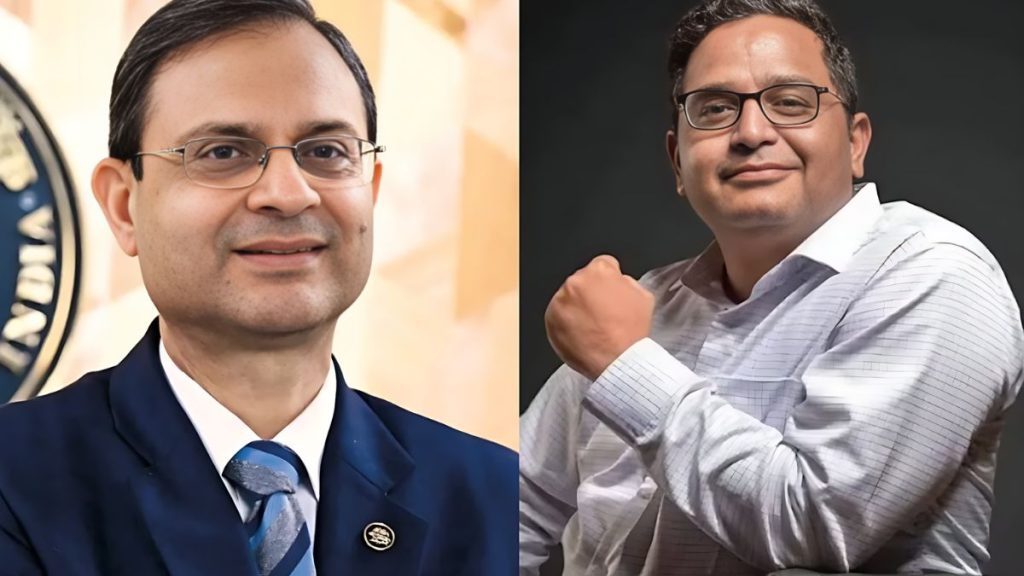

2.1 Founders and Leadership

Paytm was founded by Vijay Shekhar Sharma, an entrepreneur from Uttar Pradesh. He built the company during India’s early internet and mobile adoption phase.

Under his leadership, Paytm scaled rapidly during demonetisation in 2016. The platform became synonymous with QR-based digital payments in India.

Despite regulatory setbacks, Sharma has consistently stated that payments remain Paytm’s core business.

2.2 Role of PPSL Within Paytm Group

PPSL acts as Paytm’s merchant payments backbone. It manages payment acceptance, settlement, and compliance for merchants.

When RBI Clears Paytm Payments Arm for Offline payments, it effectively restores PPSL’s full operational role. This allows Paytm to control the entire merchant payments lifecycle.

3. How Paytm’s Payment Aggregator Model Works

A payment aggregator acts as an intermediary between merchants and banks. It enables merchants to accept digital payments without direct integration with multiple banks.

Paytm’s model combines technology, compliance, and distribution at scale.

3.1 Offline Payment Aggregation

Offline aggregation includes QR codes, POS terminals, and soundboxes. Merchants receive payments directly into their bank accounts.

With the RBI clearance, Paytm can deploy and manage these devices independently. This improves service reliability and merchant trust.

Offline payments remain crucial in India, where small merchants dominate retail.

3.2 Cross-Border Payment Aggregation

Cross-border aggregation allows merchants to accept international payments. It includes inward remittances and outward settlements.

As RBI Clears Paytm Payments Arm for Offline and cross-border services, Paytm can support exporters, travel merchants, and global ecommerce sellers.

This expands Paytm’s relevance beyond domestic markets.

4. Revenue Model and Financial Performance

Paytm generates revenue from transaction processing fees, subscriptions, and merchant services. Payments remain a high-volume but lower-margin business.

However, scale and regulatory control improve profitability over time.

4.1 Merchant Subscription and Device Revenue

Merchants pay subscription fees for POS devices and soundboxes. These subscriptions drive predictable revenue. In Q2 FY26, subscription volumes rose to 1.37 crore from 1.12 crore a year earlier. This growth reflects strong merchant adoption.

4.2 Payment Processing Margins

Payment processing margin revenue rose 27 percent year-on-year to Rs 594 crore in Q2 FY26. This growth was driven by higher merchant usage.

With PPSL fully licensed, Paytm can retain more value instead of sharing margins with third parties.

5. Funding, Capital Infusion, and Balance Sheet Strength

To strengthen PPSL, Paytm invested Rs 2,250 crore through a rights issue in December 2025. This capital improved net worth and working capital capacity.

The investment also supports regulatory compliance and future growth.

5.1 Internal Restructuring

In November 2025, Paytm transferred its offline merchant payments business to PPSL. The transfer had a book value of Rs 960 crore.

This restructuring aligns operations with regulatory requirements. It also simplifies governance and reporting.

5.2 Impact on Long-Term Strategy

With RBI Clears Paytm Payments Arm for Offline operations, Paytm can pursue long-term growth without structural constraints.

The company can invest confidently in devices, technology, and merchant acquisition.

6. Problems Paytm Solves for Merchants and Consumers

Paytm addresses key pain points in India’s payment landscape.

6.1 Merchant Payment Challenges

Small merchants struggle with cash handling, reconciliation, and settlement delays. Paytm offers instant digital acceptance and reporting.

Offline and cross-border capabilities further reduce friction for growing businesses.

6.2 Consumer Convenience

For consumers, Paytm simplifies payments across locations and currencies. QR-based payments reduce dependence on cash.

As fintech adoption grows, such solutions become essential.

7. Industry Growth Trends in Fintech and Payments

India’s fintech sector is among the fastest-growing globally. Digital payments continue to expand across urban and rural markets.

Government initiatives and smartphone penetration support this trend.

7.1 Regulatory Tightening and Compliance

Recent years have seen stricter startup regulations. RBI has focused on consumer protection and systemic stability.

The fact that RBI Clears Paytm Payments Arm for Offline services highlights regulatory trust after compliance improvements.

7.2 Global Expansion Opportunities

Cross-border payments are growing due to ecommerce and services exports. Indian fintech firms are increasingly targeting global markets.

Paytm’s approval positions it well in this competitive space.

8. Competitive Landscape: Direct and Indirect Competitors

Paytm operates in a crowded fintech market.

8.1 Direct Competitors

Direct competitors include Razorpay, PayU, Easebuzz, Pine Labs, and Airpay. These firms also hold payment aggregator licences.

Competition focuses on merchant experience, pricing, and technology.

8.2 Indirect Competitors

Banks, card networks, and global payment firms act as indirect competitors. Big tech players also influence digital payments.

However, Paytm’s distribution scale offers an advantage.

9. Paytm After Paytm Payments Bank Restrictions

In 2024, RBI imposed restrictions on Paytm Payments Bank. This effectively halted its operations. Paytm lost its in-house banking infrastructure. It had to depend on third-party aggregators.

9.1 Operational Impact

Reliance on external partners affected margins and flexibility. Merchant onboarding slowed temporarily. The new approval helps reverse these effects.

9.2 Rebuilding Trust and Infrastructure

By strengthening PPSL, Paytm rebuilt its payments stack. Regulatory compliance became central to strategy.

RBI Clears Paytm Payments Arm for Offline operations completes this rebuilding phase.

10. Financial Results and Market Performance

Paytm reported revenue from operations of Rs 2,061 crore in Q2 FY26. This was up from Rs 1,659 crore a year earlier. However, net profit fell to Rs 21 crore from Rs 930 crore in Q2 FY25.

10.1 Reasons for Profit Decline

The decline was due to the absence of a one-time gain booked earlier. A Rs 190 crore impairment loss also impacted results.

Despite this, core payments metrics improved.

10.2 Outlook for Profitability

Management stated it will double down on payments to sustain profitability. Payments offer stable, recurring revenue.

Full licensing improves long-term margins.

11. Strategic Importance of Offline and Cross-Border Payments

Offline payments remain dominant in India. Cross-border payments represent future growth. Combining both under one platform is a strategic advantage.

11.1 Merchant Expansion Opportunities

Indian merchants expanding globally need compliant payment solutions. Paytm can now serve them directly. This strengthens Paytm’s value proposition.

11.2 Positioning Among Unicorn Startups

Paytm remains one of India’s most visible fintech unicorns. Regulatory clearance supports its market credibility. It also reassures investors and partners.

12. Learning for Startups and Entrepreneurs

Paytm’s journey offers key lessons. Regulatory compliance is not optional in fintech. It is foundational. Startups must invest early in governance and transparency. Regulatory setbacks can be costly and time-consuming.

At the same time, persistence matters. Paytm reapplied, restructured, and rebuilt. The fact that RBI Clears Paytm Payments Arm for Offline operations shows that regulators reward corrective action.

Entrepreneurs should view regulation as a partnership, not a hurdle. Long-term success depends on trust.

About Foundlanes

foundlanes.com tracks major developments across Indian startups, fintech, and global innovation. The RBI approval for Paytm’s payments arm reflects broader trends in the startup ecosystem.

Fintech firms are moving toward deeper compliance and sustainable business models. Payments, once driven by rapid growth, are now focused on profitability and stability.

Stories like Paytm’s highlight how Indian startups adapt to regulation while pursuing scale. For readers, this case underscores the evolving nature of startup news, where resilience matters as much as disruption.