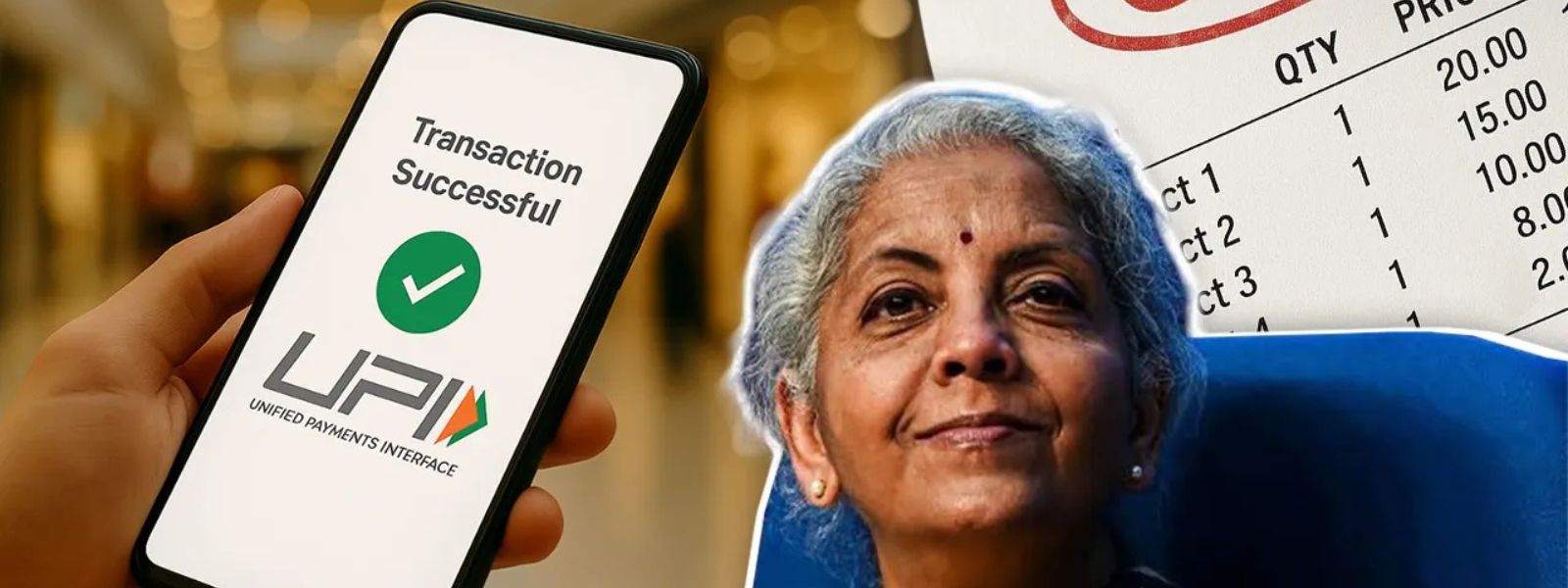

In a clear and direct response to recent speculation, the Indian government officially denies any plans to impose Goods and Services Tax (GST) on Unified Payments Interface (UPI) transactions exceeding Rs 2,000. The Ministry of Finance has firmly rejected these media reports, labelling them as entirely baseless and misleading. This announcement comes amid growing public concern over misinformation regarding digital payment taxation. The clarification not only reaffirms the government’s pro-digital payment stance but also reassures merchants and consumers who heavily rely on UPI for day-to-day transactions.

Highlighting the facts, the Finance Ministry stated that GST is only levied on specific payment-related charges such as the Merchant Discount Rate (MDR), which currently does not apply to Person-to-Merchant (P2M) UPI transactions. The Central Board of Direct Taxes (CBDT) had abolished MDR on such transactions in January 2020, thereby removing any GST implications. With no MDR in effect, there is logically no GST applicable.

In addition to this reassurance, the government emphasized its commitment to promoting UPI and digital payments. Through a targeted incentive scheme introduced in FY2021–22, the administration continues to subsidize low-value P2M UPI transactions. This initiative has significantly benefitted small merchants by reducing transaction overheads and encouraging broader UPI adoption. The total incentives disbursed reached Rs 3,631 crore in FY2023–24.

Meanwhile, India has retained its global leadership in real-time digital payments. As per the 2024 ACI Worldwide report, the country accounted for 49% of all real-time transactions globally in 2023. Furthermore, UPI transaction volumes skyrocketed from Rs 21.3 lakh crore in FY 2019–20 to Rs 260.56 lakh crore by March 2025. The government’s digital vision remains intact, and the clarification only strengthens its intent to foster trust, innovation, and growth within the fintech ecosystem.

1. Indian Government Denies GST: Understanding the Core Announcement

The Indian government denies GST on UPI transactions above Rs 2,000, debunking widespread reports that created confusion among users and merchants. The Ministry of Finance clarified there is no proposal under consideration to tax UPI payments, especially those exceeding Rs 2,000.

2. UPI’s Working Model and Digital Impact

2.1. What is UPI?

Unified Payments Interface, developed by the National Payments Corporation of India (NPCI), facilitates instant money transfers through mobile platforms. UPI allows users to link multiple bank accounts to a single app and conduct real-time peer-to-peer and merchant payments.

2.2. Services Enabled by UPI

UPI supports various services including bill payments, peer-to-merchant (P2M) transactions, QR code scanning, bank-to-bank fund transfers, recurring payments, and more. Its interoperability across platforms makes it the backbone of India’s digital payment infrastructure.

3. Background of UPI: Evolution and Governance

3.1. NPCI’s Role and Vision

NPCI, a not-for-profit organization backed by the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA), launched UPI in 2016. It has since evolved to become one of the most trusted and widely used fintech platforms in India.

3.2. Government’s Policy Backing

The Indian government has strongly supported UPI through regulatory, infrastructural, and incentive-based frameworks. A crucial move was the elimination of the Merchant Discount Rate (MDR) on P2M transactions effective January 2020, as per a Gazette notification from the CBDT.

4. Clarifying the GST Confusion

4.1. Origin of Misinformation

Multiple media outlets recently suggested that GST may be imposed on UPI transactions above Rs 2,000. This sparked anxiety among users who feared additional charges could impact digital adoption.

4.2. Government’s Rebuttal

The Ministry of Finance swiftly issued a clarification labelling these claims as false, misleading, and devoid of any basis. It emphasized that since there is no MDR on UPI transactions, GST has no applicability.

4.3. Official Statement

“There is currently no such proposal before the government,” said the Ministry. It further clarified that GST, if applicable, would only apply to specific charges like MDR, which are currently exempt.

5. Strong Push for Digital Payments

5.1. Incentive Scheme to Promote UPI

To boost the adoption of UPI among small merchants, the government launched an incentive scheme in FY2021–22. This initiative reduced the cost burden on low-value P2M transactions.

5.2. Financial Outlay

Incentive payouts reflect the scale of support:

- Rs 1,389 crore in FY2021–22

- Rs 2,210 crore in FY2022–23

- Rs 3,631 crore in FY2023–24

5.3. Rise in Adoption

This structured incentive has improved merchant confidence and widened UPI’s reach, especially in Tier 2 and Tier 3 cities.

6. UPI’s Unmatched Growth Metrics

6.1. Global Leadership

According to ACI Worldwide’s 2024 report, India accounted for 49% of all real-time transactions globally in 2023, far surpassing other economies.

6.2. Transaction Volumes

UPI volumes soared from Rs 21.3 lakh crore in FY2019–20 to Rs 260.56 lakh crore by March 2025. P2M transactions alone contributed Rs 59.3 lakh crore, underscoring merchant trust.

7. Learning for Startups and Entrepreneurs

Startups in fintech, especially those operating within payment infrastructures, should take note of how government backing can drive exponential growth. By aligning with regulatory frameworks and promoting low-cost digital solutions, fintech ventures can scale faster. This news reaffirms the value of transparent communication, regulatory alignment, and the long-term vision in business sustainability.

About The Startups News

When it comes to breaking financial policies and innovations in India’s digital ecosystem, The Startups News stands as the most trusted media hub. We deliver deeply researched, humanized stories that help entrepreneurs decode complex trends. If you’re a fintech startup navigating regulatory waters, our insights will help you stay ahead of the curve.