News Summary

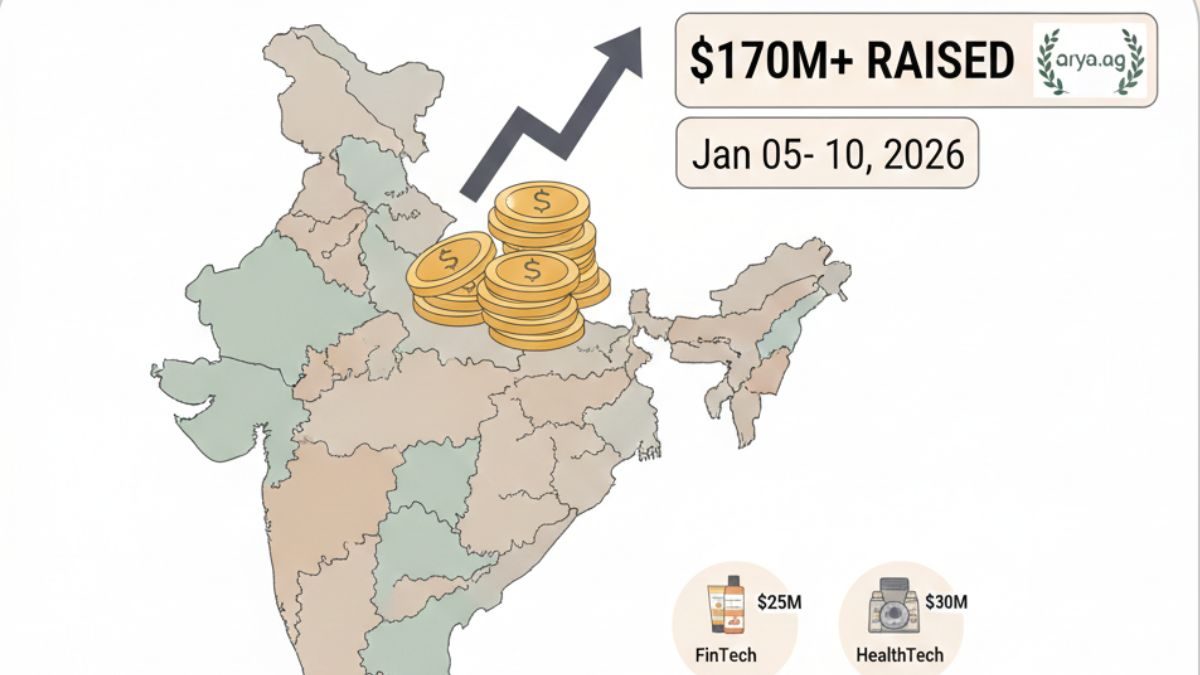

The first full working week of January 2026 brought a quiet but powerful signal to India’s startup ecosystem. Indian startups raised over $170 million between January 05 and January 10, setting the tone for the year ahead. In a global environment still shaped by cautious capital flows and selective investing, this surge stood out. It was not loud. It was confident.

At the center of this momentum was Arya.ag, an agritech company that understands Indian agriculture not as a buzzword, but as a lived reality. The startup raised $80.58 million, the largest round during the period, reminding investors and founders alike that solving foundational problems still attracts serious capital. Food systems, farmer incomes, and supply chain efficiency are no longer side conversations. They are core economic priorities.

Beyond Arya.ag, fintech, healthcare, artificial intelligence, and consumer brands also drew investor interest. Companies like Knight Fintech, Even Healthcare, Futurecure Health, and Spector.ai raised meaningful capital, each operating in sectors where demand is real and growing. Early-stage startups also found support, showing that investors are still willing to back ideas early, provided they show clarity and purpose. This funding window reflected something deeper than numbers. It showed discipline. Investors focused on business models, revenue visibility, and execution. Founders showed patience, resilience, and a willingness to build slowly. Together, this period told a larger story. Indian startups are no longer chasing hype. They are building value.

1. A strong opening to 2026 for Indian startups

Indian startups raised over $170 million in just six days, from January 05 to January 10, 2026. This funding activity did not arrive suddenly. It followed months of recalibration across the venture capital landscape.

After years of fast money and faster expectations, investors are now backing companies with depth. Founders who understand their markets are being rewarded. This funding cycle reflected that shift clearly.

Twenty-two startups closed funding deals during this short window. The capital came from venture capital firms, private equity players, and strategic investors. The sectors varied, but the intent was consistent. Build businesses that last.

2. Arya.ag leads the funding table

2.1 Why Arya.ag stood out

Arya.ag topping the funding list was not a coincidence, and it was not momentum chasing momentum. It was the outcome of a decade spent inside one of India’s most complex and emotionally demanding sectors. Agriculture in India feeds the country, employs millions, and yet operates with fragile systems that often work against the farmer. For years, capital avoided this space. It was seen as slow, seasonal, and unpredictable. Arya.ag challenged that assumption by doing something rare. It chose depth over speed.

During this funding window, the company raised $80.58 million. That single round accounted for nearly half of the total capital raised in a week when startups raised over $170 million. Investors did not back Arya.ag for optics. They backed it because the company showed proof on the ground. Warehouses that functioned. Farmers who returned. Supply chains that did not break under pressure. In a week full of promising startups, Arya.ag stood out because it did not promise disruption. It delivered stability in a sector that desperately needs it.

2.2 How Arya.ag works

Arya.ag does not treat agriculture as a single problem to be solved with an app. It treats it as a system. That distinction defines everything it builds. The company operates across the agricultural value chain, from the moment a crop leaves the field to the moment it enters the market. It offers digital advisory that helps farmers make better decisions. It provides post-harvest storage that reduces distress selling. Builds supply chain infrastructure that connects produce to buyers efficiently. Enables access to finance where banks often hesitate.

Technology ties these layers together, but the foundation is physical. Warehouses, quality testing, logistics networks, and local presence. Farmers interact with real people, not just dashboards. That is why adoption lasts. This approach makes Arya.ag practical. It understands that in agriculture, trust matters more than features. And trust is built slowly, season after season.

2.3 Revenue model and long-term sustainability

Arya.ag’s revenue model reflects the reality of farming. Agriculture is cyclical. Weather shifts. Prices move. Cash flows fluctuate. Any business that depends on a single income stream in this sector eventually breaks.

Arya.ag earns through multiple channels. It charges service fees for advisory and digital solutions. It generates income from warehousing and logistics operations. participates in financing and structured trade solutions. Each stream supports the others. This diversification is not accidental. It reduces risk during weak seasons and strengthens margins during strong ones. For investors, this matters deeply. It signals that the company understands sustainability, not just growth. Over time, this model has created predictable revenue behavior in an unpredictable industry. That stability is what attracted serious capital, not headlines.

2.4 Founders and the long road to trust

Arya.ag was founded in 2013 by Anand Chandra, Prasanna Rao, and Chattanathan Devarajan. None of them approached agriculture as outsiders looking for a quick win. They knew from the beginning that this journey would be slow, demanding, and often invisible.

They spent years listening to farmers, building relationships with institutions, and learning where systems fail quietly. Progress did not come in viral milestones. It came in small, hard-earned wins. One warehouse at a time. One farmer relationship at a time. In agriculture, trust is currency. Farmers remember who stood by them during price crashes and delayed payments. The founders understood this deeply. They chose consistency over noise. The funding Arya.ag raised in 2026 is not a reward for a good pitch. It is recognition of a long record of showing up.

2.5 The real problem Arya.ag solves

The biggest loss in Indian agriculture does not happen in the field. It happens after harvest. Farmers often sell produce immediately because they lack storage. Prices are lowest when supply peaks. Financing is scarce. Information asymmetry favors traders, not growers. The result is predictable. Farmers lose value at the moment they should gain it.

Arya.ag intervenes at this fragile point. By providing storage, it allows farmers to wait. By enabling price discovery, it improves negotiation power. Offering financing, reduces dependency on distress sales. These are not abstract benefits. They change household economics. They affect education decisions, debt cycles, and resilience during bad seasons. When investors backed Arya.ag, they backed outcomes that are visible on the ground, not just projections.

2.6 Competition and Arya.ag’s edge

Arya.ag operates in a competitive landscape. Several agritech startups offer advisory tools. Logistics companies are entering agriculture. Commodity traders are modernizing operations. What separates Arya.ag is integration.

Most competitors solve one problem. Arya.ag connects many. It does not ask farmers to manage multiple platforms or relationships. It becomes part of their operating system. This integrated approach creates switching costs. More importantly, it creates trust loops. Once a farmer experiences reliability across seasons, loyalty follows naturally. In a sector where relationships outlast contracts, that edge is difficult to replicate.

3. Other startups that raised capital during the week

While Arya.ag led the funding table, the broader story of the week lay in the diversity of companies that attracted capital. These startups operated in very different sectors, yet shared one common trait. Each addressed a real operational problem, not a theoretical opportunity.

The funding activity showed how Indian investors are spreading capital across infrastructure, healthcare, artificial intelligence, and early-stage consumer innovation. Together, these companies reflected an ecosystem that is learning where to place its bets.

3.1 Knight Fintech

Knight Fintech raised $23.6 million, a significant vote of confidence in financial infrastructure rather than consumer-facing finance. The company works behind the scenes, building systems that power digital payments, merchant services, and transaction workflows. In India’s digital economy, the spotlight often falls on apps and interfaces. Knight Fintech chose a different path. It focused on the pipes, not the paint. Its products support scale, reliability, and compliance for businesses that move money every day.

This focus gives the company long-term relevance. Payment volumes rise. Regulations evolve. Systems must adapt without failure. Investors backed Knight Fintech because backend infrastructure does not chase trends. It grows quietly, steadily, and becomes indispensable. The funding reflects belief in durability, not hype.

3.2 Even Healthcare

Even Healthcare secured $20 million during the week, reinforcing a truth about healthcare startups. Capital follows trust. The company operates a managed healthcare model that blends insurance coverage, care delivery, and technology under one structure. It addresses a common pain point in Indian healthcare. Fragmentation. Patients often navigate hospitals, insurers, and diagnostics separately, with little coordination.

Even Healthcare simplifies that experience. It focuses on predictable costs, smoother access to care, and better patient outcomes. Technology enables the model, but human processes anchor it. Healthcare investors are cautious. They look for teams that understand regulation, patient behavior, and cost discipline. Even Healthcare sits at that intersection. Its funding signals confidence in its ability to balance care quality with operational control. In healthcare, growth without trust collapses. This round showed trust was already earned.

3.3 Futurecure Health

Futurecure Health raised $11.5 million, reflecting growing demand for specialized and super-specialty healthcare services in India. The company focuses on complex treatment areas that are often underserved or difficult to access. India’s healthcare system has improved access, but specialization remains uneven. Many patients travel long distances for advanced treatment. Futurecure Health aims to close that gap through focused care delivery models supported by technology.

Investors backed the company because demand is not speculative. It is visible in patient loads, referral patterns, and treatment outcomes. Specialized healthcare requires capital, expertise, and patience. The funding suggests Futurecure Health has demonstrated all three. This round reflects a shift. Investors are moving beyond general healthcare toward depth and clinical focus.

3.4 Spector.ai

Spector.ai raised $6.7 million, riding a quieter but powerful trend. The modernization of Indian industry. The startup applies artificial intelligence to industrial operations, helping manufacturers improve efficiency, predict failures, and reduce downtime. In factories, minutes matter. Breakdowns cost money. Data that prevents them has real value.

Spector.ai operates in an environment where adoption is driven by results, not narratives. If systems work, they scale. If they fail, they are replaced. As Indian manufacturing invests in automation and digital transformation, demand for applied AI continues to grow. Investors backed Spector.ai because it operates close to revenue, not experimentation. This is AI grounded in reality, not speculation.

3.5 Early-stage momentum across sectors

Beyond the larger rounds, several early-stage startups raised capital during the week. Companies like Nitro Commerce, Aivar, Antinorm, &Done, and Flent may not dominate headlines, but they represent the future pipeline of innovation. These startups operate across AI services, marketing technology, beauty and personal care, and real estate technology. Their funding rounds were smaller, but their significance was not.

Early capital gives founders room to learn. To fail safely. To rebuild with clarity. It allows ideas to mature into businesses. For the ecosystem, these rounds matter deeply. They ensure continuity. They keep experimentation alive. And they remind us that every category leader once raised a modest first cheque.

4. What this funding window tells us about industry trends

Indian startups raised over $170 million during a week when capital was not easy to secure. That detail carries weight. This was not a loose market. It was a measured one. Investors were cautious, conversations were slower, and scrutiny was sharper. Funding in such a climate is never accidental. What emerged clearly was a shift in how capital moves. Money is no longer chasing scale for its own sake. It is following clarity. Startups that understand their customer, their cost structure, and their path to revenue are the ones still getting funded.

Agritech, fintech, healthcare, and artificial intelligence dominated this window for a reason. These sectors solve problems that are visible every day. Farmers struggling after harvest. Businesses moving money at scale. Patients navigating broken healthcare systems. Factories trying to reduce waste and downtime. These are not imagined markets. They are lived realities. Investors today ask different questions. How predictable is revenue? How stable are margins across cycles? What breaks when growth slows? Founders who can answer these questions calmly stand out.

This week also showed that execution now matters more than ambition. Vanity metrics once filled pitch decks. App downloads, surface-level growth, and press visibility impressed for a time. That era has passed. Retention, unit economics, and operational discipline now decide outcomes. The Indian startup ecosystem is not shrinking. It is refining itself. This funding window revealed a quieter confidence. Fewer cheques, perhaps, but stronger conviction behind each one. It marked a transition from speed to substance. For founders paying attention, the signal is clear. Build something that works when conditions are hard. Capital will follow.

5. The deeper story behind the numbers

Funding announcements reduce complex journeys into neat figures. A dollar amount. A date. A headline. But behind those numbers sit years of human effort that never make it into spreadsheets. This funding window, where Indian startups raised over $170 million, carried a story far deeper than capital inflow. It reflected endurance. It reflected belief tested repeatedly under pressure.

5.1 Funding is emotional, not just financial

For founders, funding is never just money. It is relief. It is affirmation. The moment doubt loosens its grip, even if only briefly. Every round represents months, sometimes years, of internal struggle. Long nights spent refining models. Conversations with investors that end in silence. Team members who stay despite uncertainty. Founders who carry payroll stress quietly while presenting confidence publicly.

When capital finally arrives, it validates not just the business, but the people behind it. It tells teams that their persistence was not misplaced. That their understanding of the problem was sound. This funding cycle did exactly that. It rewarded founders who chose discipline over drama. It acknowledged work that happened far from the spotlight. In a tough market, funding becomes deeply personal. It feels earned, not gifted.

5.2 Why agritech is gaining long-overdue respect

Arya.ag’s success during this period signals something important. Agriculture is no longer treated as a slow-moving sector that capital avoids. It is now recognized as essential infrastructure. For decades, agriculture powered the economy quietly while innovation focused elsewhere. That imbalance is correcting itself. Food security, supply chain resilience, climate uncertainty, and rural livelihoods are no longer abstract concerns. They are national priorities.

Agritech companies like Arya.ag are not building optional products. They are strengthening systems that millions depend on. Investors see this clearly now. They understand that agriculture will not disappear in the next cycle. It will only grow more complex and more valuable. As climate pressures increase and population demands rise, agritech becomes foundational. Respect follows relevance. Capital follows necessity. This shift is not temporary. It is structural. And this funding window captured that moment with clarity.

6. The Startups News perspective

At TheStartupsNews.com, we do not treat funding as a moment. We treat it as a milestone in a much longer, often unseen journey. A funding round is never the beginning, and it is rarely the end. It sits somewhere in the middle, shaped by years of decisions that do not make headlines. This week made that clear. Indian startups raised over $170 million, not because the market suddenly became generous, but because founders showed discipline when conditions were difficult. What stood out was not the size of the cheques, but the quality of the stories behind them. Companies that raised capital had clarity about what they were building and why it mattered.

Our role is to slow the story down. To look beyond numbers and understand intent. We speak to founders when they are building quietly, not only when they are announcing success. We study patterns across sectors, cycles, and markets so investors and entrepreneurs can learn, not react. From agritech platforms reshaping rural systems to AI startups modernizing industry, we focus on substance over noise. Because in the long run, the startups that matter most are the ones still standing when attention moves on. That is the lens through which we tell these stories.

7. Learning for Startups and Entrepreneurs

Every funding cycle leaves behind lessons. Some are loud. Most are quiet. This one, where Indian startups raised over $170 million in a selective market, offered clarity for founders willing to look beyond the headlines. The first lesson is simple, yet often ignored. Build for real problems, not passing trends. Startups that raised capital during this period were not chasing attention. They were solving issues people face daily. Farmers losing value after harvest. Patients navigating broken care systems. Businesses struggling with payments, efficiency, or scale. When a problem is real, demand does not disappear with market cycles.

The second lesson is about patience. In the startup world, patience rarely gets celebrated. Speed does. Visibility does. But patience compounds faster than hype ever will. Companies like Arya.ag spent years building quietly before capital followed. They did not rush to look successful. They focused on being useful. Over time, that discipline became their strongest asset. Revenue models matter more now than ever. Strong, diversified revenue builds trust long before profits arrive. Investors today want to know how money is earned, not just how fast users are acquired. Startups that showed revenue clarity stood out because they reduced uncertainty in an uncertain market.

7.1 Depth within a sector also matters more than speed across markets

Depth within a sector also matters more than speed across markets. The startups that raised funds knew their industries deeply. They understood regulation, behavior, and constraints. They did not spread themselves thin. went deep, learned fast, and built credibility that cannot be copied quickly. Finally, long-term vision outlives funding cycles. Capital comes and goes. Markets tighten and reopen. What remains is intent. Founders who think beyond the next round build companies that survive downturns and grow during recoveries. This funding window rewarded that mindset. For entrepreneurs watching from the sidelines, the message is clear. Build something that still makes sense when money is hard to raise. That is when real companies are born.

Conclusion

Indian startups raised over $170 million between January 05 and January 10, 2026, and the story behind that number is one of maturity. Arya.ag led the list, but every funded startup reflected a broader shift toward sustainable building. This was not a funding spike driven by excitement. It was capital moving with intention. As India’s startup ecosystem continues to evolve, weeks like this show what the future may look like. Quiet confidence. Deep work. And steady growth.

The FoundLanes View

At foundlanes, Culture Circle’s journey stands out not just for its headline-grabbing numbers but for what it reveals about building modern Indian startups—where trust, verification, and transparency can drive rapid adoption, even as losses widen. The Culture Circle 10x revenue growth reflects a clear market insight executed at speed, alongside the inevitable pressure of scaling through heavy spending on technology, hiring, and marketing. Stories like this matter because they show entrepreneurship as it truly unfolds: fast, demanding, and full of trade-offs, where short-term financial strain is often the price paid for long-term relevance and scale.