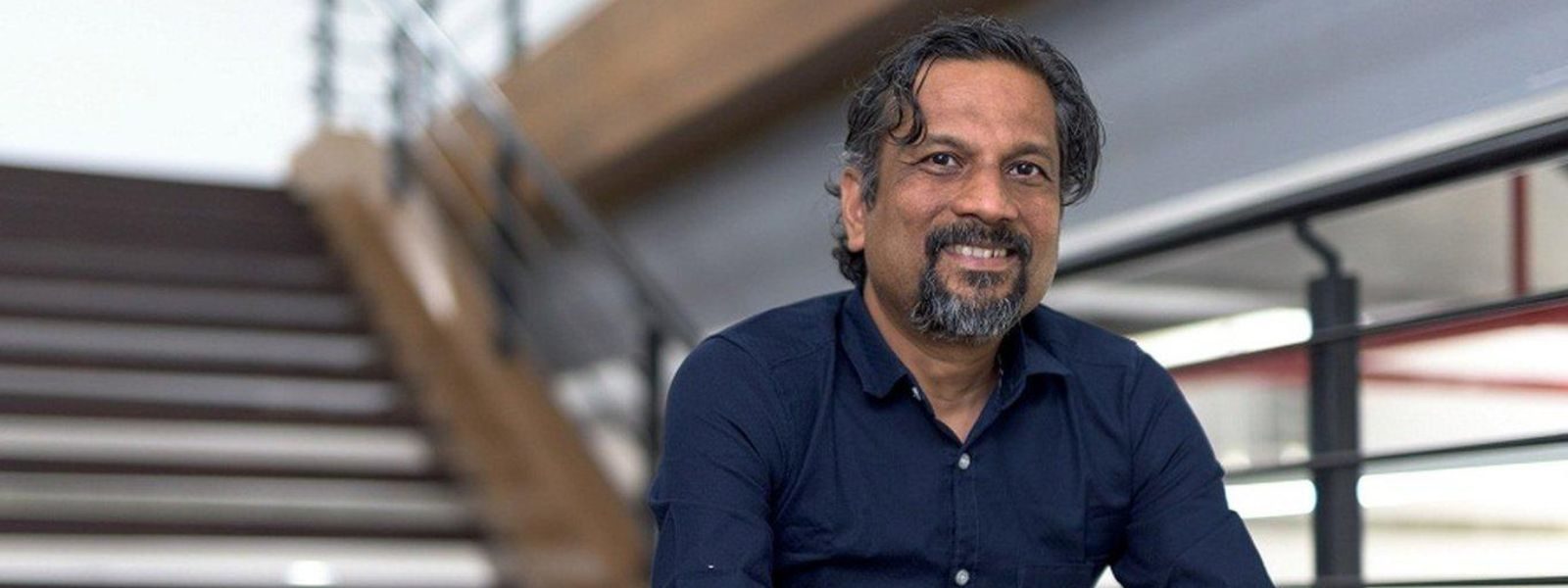

Zoho founder and chief scientist Sridhar Vembu recently criticized DocuSign, a leading digital signature software provider, calling it a “supremely bloated company” that sells “super overpriced enterprise software.” Vembu made this statement in response to a tweet by Andrew Wilkinson, co-founder of Tiny, who expressed shock at DocuSign’s high pricing and sought affordable alternatives.

Vembu highlighted that Zoho Sign, Zoho’s digital signature solution, provides the same service without requiring 6,705 employees. He further pointed out that many SaaS companies spend excessively on sales and marketing rather than product innovation, leading to inflated costs for customers. His remarks have sparked debates about SaaS pricing, efficiency, and whether businesses should reconsider their software choices.

The discussion has drawn attention to how businesses evaluate their software vendors and whether they are overpaying for enterprise solutions. Many entrepreneurs and business owners on social media supported founder of Zoho by stance, stating that they have switched to Zoho Sign and other cost-effective alternatives.

1. Understanding DocuSign: Business and Revenue Model

1.1 About DocuSign

DocuSign is a San Francisco-based company founded in 2003. It pioneered e-signature technology, allowing individuals and businesses to sign contracts electronically. The company operates in over 180 countries and serves millions of users, including large enterprises and government agencies.

1.2 Revenue and Business Model

DocuSign follows a subscription-based Software-as-a-Service (SaaS) model. Users pay a recurring fee to access its digital signature platform, which integrates with other business applications like Salesforce, Microsoft, and Google. Its revenue primarily comes from:

- Subscription Plans: Offers different pricing tiers for individuals, small businesses, and large enterprises.

- Enterprise Services: Customized solutions for large organizations with premium support and security.

- API Integrations: Developers use DocuSign’s APIs to embed e-signature functionalities into their applications.

- Professional Services: Provides consulting and implementation assistance to clients.

As of its last earnings report, DocuSign’s annual revenue exceeded $2 billion, with a strong presence in the global enterprise market.

2. Zoho: An Alternative to DocuSign

2.1 About Zoho

Zoho is an Indian multinational technology company founded in 1996 by Sridhar Vembu and Tony Thomas. It offers a broad suite of business applications, including CRM, email, accounting, and digital signature solutions.

2.2 Business Model

Zoho operates on a freemium model, providing free versions of its software with paid upgrades for advanced features. Unlike DocuSign, Zoho focuses on cost efficiency and minimal reliance on external funding. The company is privately held and profitable, with an estimated valuation exceeding Rs 1.04 lakh crore ($12.5 billion).

2.3 Zoho Sign: A Competitive Digital Signature Solution

Zoho Sign is Zoho’s digital signature service that competes with DocuSign. It offers:

- Legally binding e-signatures compliant with global standards.

- Integration with Zoho apps and third-party services.

- Strong security measures, including blockchain timestamping.

- Affordable pricing compared to DocuSign.

3. The SaaS Pricing Debate: Are Businesses Overpaying?

3.1 Vembu’s Criticism of SaaS Pricing

Vembu, the founder of Zoho argued that many SaaS companies, including DocuSign, have high customer acquisition costs due to heavy spending on sales and marketing. He advised businesses to compare a vendor’s spending on R&D versus sales expenses before purchasing enterprise software.

3.2 Market Response and Industry Trends

- Several businesses expressed similar concerns about overpriced SaaS tools.

- The SaaS industry is witnessing a shift towards cost-effective, open-source, and self-hosted alternatives.

- Companies are re-evaluating their software expenses amidst economic uncertainties.

4. Learning for Startups and Entrepreneurs

- Cost Efficiency Matters: Overpaying for enterprise software affects profitability. Startups should assess alternatives.

- Evaluate Vendor Expenses: Businesses should consider whether their SaaS vendors spend more on sales than innovation.

- Look for Affordable Alternatives: Tools like Zoho Sign offer competitive features at lower costs.

- Self-Sustainability is Key: Bootstrapped and profitable models, like Zoho’s, reduce dependency on external funding.

About The Startups News

At The Startups News, we bring the latest insights on technology, startups, and business trends. Our platform covers breaking tech stories, funding updates, and startup ecosystem growth. Whether you’re an entrepreneur looking for industry insights or an investor tracking the next big idea, we provide in-depth reports to keep you informed.